Tips

You may be reading a totally free article with views that can differ from This new Motley Fool's Advanced Using Properties. End up being good Motley Deceive representative right now to get immediate access to help you our ideal specialist recommendations, in-depth lookup, purchasing info, and a lot more. Discover more

Paying a home loan are going to be a great capital best right up to help you advancing years.

Because you approach retirement, you may have a huge financial harmony clinging over your mind. The average 60-things domestic has actually about $243,100 from inside the a good financial financial obligation. Settling those people fund tends to be a sensible circulate to possess a good lot of soon-to-getting retirees.

A mortgage try a predetermined-earnings asset your sold

A lot of people diversify the portfolios from the allocating the its investment to help you holds and also the rest to repaired-income investment such bonds. A home loan is actually a fixed-money house. There is a whole marketplace for home loan-recognized ties, which can be basically just bundles out-of mortgage loans.

For those who have a mortgage balance, it is similar to promoting home financing brief. To phrase it differently, it's a terrible fixed-income house.

Therefore http://availableloan.net/installment-loans-ks/chase, you really need to to alter your own profile in order to take into account the mortgage harmony as a workbench towards the thread or other repaired-income house allowance. Instance, imagine if we want to maintain a split between holds and you can fixed income inside the a good $step 1,one hundred thousand,one hundred thousand portfolio having a beneficial $200,100 mortgage balance. You'd you would like $480,100000 out-of carries and you will $520,100000 from repaired-income possessions on the financing portfolio to help make a websites separated. That's because new repaired-earnings allocation is faster by your $200,one hundred thousand financial harmony.

While comfy undertaking brand new math and you will accounting on the counterweight out of a home loan on your repaired-money assets, after that maybe possessing a mortgage when you look at the advancing years work aside to you personally. Nevertheless also need to believe whether or not carrying the loan was an educated use of your bank account.

What's the get back into paying off home financing?

2020 and you can 2021 considering a keen opportune going back to people to help you re-finance their most recent fund. Most people noticed their home loan prices get rid of less than step three% after they refinanced through that period. Having the present rising prices prices, those mortgage loans has actually bad real interest rates. To put it differently, paying the minimal thereon obligations are a good idea while the it increases your to buy electricity continuous.

Generally speaking, dealers with very long views you'll think leveraging their home loan so you can purchase more into the brings. Holds possess higher requested efficiency across the longer term, but make much more volatility for the a portfolio. Younger investors can also be generally deal with one to improved volatility, that's increased from the maintaining a giant financial harmony. In the end, it will write more substantial nest-egg in order to retire on the.

However, retired people would like to survive their portfolio, and you will resource preservation becomes more very important as you means old-age and you will glance at the first few many years of life on your investment. And since home financing may have a significant influence on portfolio conclusion instance how much to spend some so you're able to securities, a great retiree would be to compare the latest questioned worth of repaying a mortgage to buying securities.

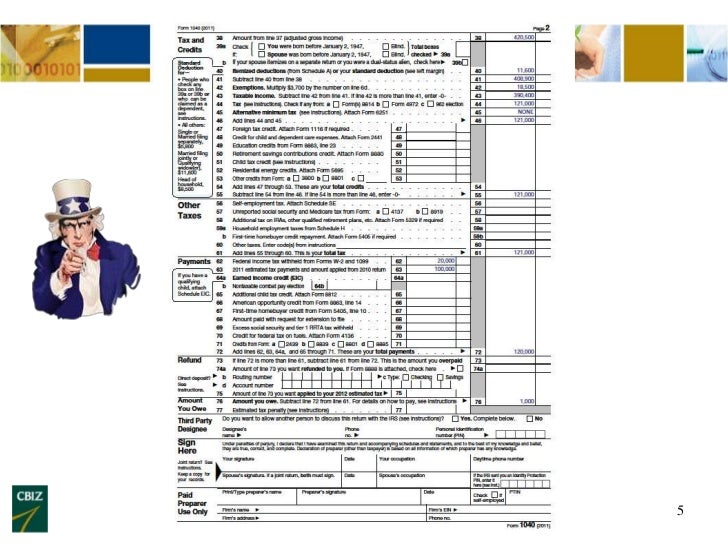

For a mortgage, the newest calculation is easy. If you take the product quality deduction in your fees, this new get back is the interest of financial.

Choosing income assumption to have committing to securities requires a small bit of guesswork. Historically, even if, Treasury securities has actually only remaining up with rising cost of living when you find yourself providing an excellent counterbalance so you're able to holds. Going forward, people ought not to assume even more than just rising prices-coordinating efficiency of Treasuries.

The fresh Given anticipates to locate inflation back down so you can on dos.3% by 2024. Really mortgages have an interest speed over that matter. Thus, by paying on the home loan, you'll receive an ensured confident genuine go back, which could surpass Treasury bonds on your own portfolio. (If you find yourself extremely bullish with the ties, however, you are able to power your own financial to save additional money from the asset group.)

Crucial genuine-lifestyle factors

You will find several techniques that can move the balance when you look at the like off carried on in order to more sluggish pay down your own home loan while in the retirement.

You'll find probably certain income tax implications in order to selling possessions on your collection to pay off the loan. If the a hefty part of the portfolio is during an income tax-advantaged later years account, you can bear a really high tax bill to pay off your own financial in one huge chunk. Or you possess property that have much unrealized money increases, it may be much more beneficial to pass on the fresh sales of those securities out over several ages.

The connection market is currently in just one of its terrible many years to own buyer yields ever. It may sting to sell in the event your capital is actually down ten% so you're able to 20%, but investors must be thinking about requested returns moving forward. If you were to think the marketplace are poised to help you rebound sharply and you will surpass, it is possible to maintain your mortgage in order to hold alot more securities. But if you don't think bonds have a tendency to go beyond the historic actual production throughout the average to help you long term, paying off the mortgage tends to make plenty of feel.

It's not necessary to pay back the loan at once. Possibly the home loan incentives plan going for the senior years is simply allocating new portion of retirement deals contributions who would wade to your ties to the their mortgage rather. Like that you could potentially keep your property instead of selling, taking on no tax effects.

Retirees that have adequate deductions in order to itemize on their tax statements may also discover less benefits from paying down the financial. The speed has to be less of the income tax deduction of investing home loan notice, so be sure to component that into the calculations.

Settling their mortgage will make clear your retirement think. Not only can they help you would a well-balanced later years portfolio, it is going to and additionally make sure your expenditures be consistent throughout retirement. You will not has actually a huge range item shedding from halfway through senior years when you reduce the mortgage organically. Therefore, not only will they sound right mathematically, it makes believe alot more important too.